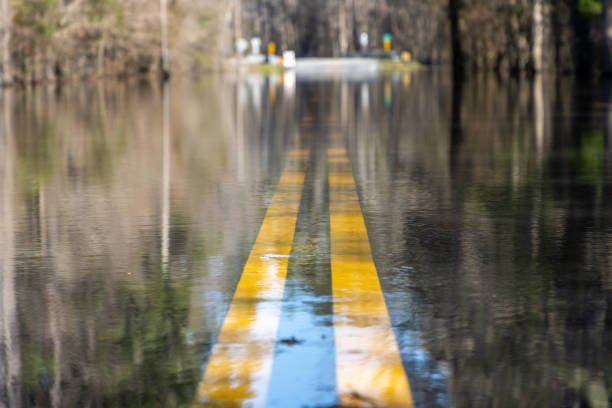

According to the Federal Emergency Management Agency, floods are the most widespread and costly disaster in the United States. Millions of dollars are lost each year by homeowners in the United States due to flood-related damage. Flooding can strike anywhere, even if you live inland. Between 1996 and 2019, 99% of the counties in the United States were impacted by flooding.

Flooding can be caused by rain storms or hurricanes. It can also be caused by melting snow, storm drainage system blockages, or failed dams and levees. Flood insurance is not available through homeowners insurance so you will need separate flood insurance for your home and contents.

Who Should Get Flood Insurance?

People often believe that flood insurance is only necessary if they are located in high-risk areas which is one of the many tall tales of real estate and insurance. However, a large percentage of flood claims are made by properties outside high-risk flood areas.

Flood insurance may be required depending on where you live. Federal law requires that flood insurance be purchased by insured or regulated lenders for homes in flood-prone areas.

If you have been eligible for federal disaster assistance, flood insurance may be required if you are located in a high-risk flood area. If you have such circumstances and do not have flood insurance, you may be ineligible to receive future disaster assistance. Your lender may require that you have flood insurance, even if your home is not in a high-risk zone.

What is Covered in Flood Insurance?

Your home is protected up to $250,000 when you purchase flood insurance. You can choose from two different forms of coverage: replacement cost basis where you are reimbursed at the current cost for new materials and home construction or actual cash basis where you are reimbursed for material costs minus depreciation. Remember that contents such as furniture or appliances are not covered by insurance unless purchased separately!!

Private insurance may be available if you require additional coverage or if you live in a community that is not part of NFIP. These policies usually do not have a deductible.

What Isn’t Covered in Flood Insurance?

Non-essential items are not covered by flood insurance. Carpeting, furniture, and basement contents are not covered. Flood insurance policies also don’t cover living expenses if you have to temporarily move while your home is being repaired or replaced.

How Do I Buy Flood Insurance?

Flood insurance is sold mainly through the National Flood Insurance Program. This type of coverage is also sold by around 120 private insurance companies. An insurance agent will be able to help you purchase an NFIP plan as these policies cannot be purchased directly from the government.

How Much Does Flood Insurance Cost?

The average flood insurance cost is $700. However, residential flood insurance premiums can come out to be quite a bit less depending on where your home is. Costs can also be affected by the year your house was built, the number of floors in the home, and the amount of coverage you have.

Flood insurance can also be purchased from private companies in which prices will also vary depending on where you live. A home in a high-risk zone could cost thousands more to insure over a home in a low-risk flood zone.

FEMA releases maps every so often that show the danger of flooding in American communities and Special Flood Hazard Areas which are the areas at the highest risk of flooding. You will likely pay more for coverage if your home is in one of these areas.

How is Flood Insurance Used?

Flood insurance covers flood-related damage and flooding. In simple terms, a flood refers to excess water on land that is normally dry and covers at least 2 acres or damages 2 properties at the least. Typically, homeowners who buy flood insurance policies must wait around a month for it to take effect before they can be used. This is to stop people waiting until flooding is imminent before buying a policy.

There are exceptions to this rule. For example, if you just bought a house or are becoming a homeowner for the first time, there may be a shorter waiting period. Private flood insurance providers have a shorter waiting time of between 10 and 14 days. You should notify your agent as soon as you can if you have to file a flood insurance claim.

Conclusion

Flood insurance is important to have whether you live in a high-risk flood zone or a low-risk flood zone. Make sure you do your research and buy flood insurance for your home as soon as you can. You don’t want to be caught off guard!!